This article presents a data-driven outlook on edge AI vision trends in 2026, focusing on four industries where cost, scalability, and regulatory pressure are fundamentally reshaping how AI systems are deployed:

Digital Signage & DOOH Media Players

AI Retail Terminals (Kiosks, Self-Checkout, Smart Scales)

Robotics & Autonomous Systems

Industrial AI Boxes & Embedded Edge Computing Platforms

2026 three possible “dark horse” scenarios

Who this article apply for:

CEOs, CTOs, founders, product managers, and senior engineers responsible for designing, deploying, or scaling edge AI systems.

What readers will gain:

A clear understanding of why edge AI vision is accelerating, where commercial demand is concentrating, and how infrastructure-level decisions are becoming more critical than model-level innovation in 2026.

Quick conclusion and important industry data

|

Industry Sector |

The 2025 Pain (The Problem) |

The 2026 Shift (The Solution) |

The Business Impact (Why Act?) |

|

Retail (SCO) |

3.75% Shrink Rate due to "Item Switching" (Banana Trick). |

Edge Inference on retrofitted 15mm Micro Cameras. |

Protect Margins: Real-time fraud prevention before payment. |

|

Robotics (AMR) |

Downtime caused by loose consumer USB cables under vibration. |

Industrial Connectivity & Global Shutter Sensors. |

Guarantee Uptime: 99.9% reliability in logistics centers. |

|

Digital Signage |

Ad Lag (>200ms) & Overheating Players. |

Embedded NPU (On-Camera Processing). |

Boost Engagement: <50ms trigger time for interactive ads. |

|

Industrial IoT |

"Cloud Tax": Streaming raw video costs ~$795k/year per fleet. |

Data Minimization: Sending Metadata (Text) only. |

Cut OpEx: Reduce AWS/Cloud ingestion fees by 68%. |

2026 Edge AI Vision: From Pilot Projects to Profitable Reality

While Digital Signage, Kiosks, and Robots seem like different industries, in 2026, they face the same engineering challenge: How to fit high-performance 'Eyes' (AI Vision) into increasingly smaller, hotter, and smarter Edge devices? We analyzed the top 5 sectors driving the Edge AI revolution one by one as following

1. Why 2026 Is a Turning Point for Edge AI

Edge AI vision refers to the deployment of computer vision and analytics directly on local devices—such as digital signage players, AI retail terminals, robots, and industrial AI boxes—without streaming raw video to the cloud. In 2026, this architecture is becoming critical for cost control, privacy compliance, and real-time decision-making across multiple industries.

Before talking about digital signage players or AI retail, we need to ask a simple question:

Is money really flowing into edge AI, or is this still mostly slides and hype?

Recent 2025 data says the shift is very real:

|

Industry / Focus |

2024/2025 Size (closest) |

2030 / 2034 Forecast (closest) |

Stated CAGR % (period) |

Source / Agency (type of report) |

|

Global Digital Signage – overall market; interactive/AI part is fastest‑growing but not broken out numerically |

Grand View: USD 28.83B in 2024. grandviewresearch+1 GMI: ~USD 22B in 2024 (different scope). |

Grand View: USD 45.94B by 2030. grandviewresearch+1 GMI: USD 49.4B by 2034. |

Grand View: 8.1% (2025–2030). grandviewresearch+1 GMI: 8.5% to 2034. |

Grand View Research “Digital Signage Market Size & Share 2030” and data‑book outlook.grandviewresearch+1 Global Market Insights 2025–2034 report.gminsights |

|

Edge AI Hardware – dedicated chips / modules (CPU, GPU, ASIC, NPU at the edge) |

MarketsandMarkets: USD 26.14B in 2025 (edge AI hardware revenue). marketsandmarkets+1 Mordor: USD 26.17B in 2025 (similar scope). |

MarketsandMarkets: USD 58.90B by 2030. marketsandmarkets+1 Mordor: USD 59.37B by 2030.mordorintelligence |

~17.6–17.8% (2025–2030). |

MarketsandMarkets “Edge AI Hardware Market… Global Forecast to 2030”.marketsandmarkets+1 Mordor Intelligence Edge AI Hardware Market.mordorintelligence |

|

Edge AI in Retail – AI at the edge in retail, including loss prevention use cases |

Market.us / Edge AI in Retail report: USD 15.4B in 2024. |

Market.us: USD 173.47B by 2034. |

27.40% (2025–2034). |

Market.us “Edge AI in Retail Market Size, Share |

|

AI in Retail – broader AI in retail (cloud + edge, including loss prevention) |

Mordor (Q&A within report): USD 14.24B in 2025; forecast cites strong growth. mordorintelligence MarketsandMarkets: USD 31.12B in 2024.marketsandmarkets |

MarketsandMarkets: USD 164.74B by 2030 (AI in Retail overall). |

MarketsandMarkets: high‑double‑digit CAGR to 2030 (exactly 30%+; report states 2024–2030). |

MarketsandMarkets “Artificial Intelligence in Retail Market”. marketsandmarkets Mordor Intelligence AI in Retail report with loss‑prevention and edge‑hybrid segments. |

|

Warehouse Robotics – warehouse robots with focus on AMR & AGV |

Mordor: Warehouse Robotics Market USD 9.33B in 2025.mordorintelligence AGV/AMR only: USD 6.02B in 2024; USD 6.4B in 2025 in other structured sources. |

Mordor: USD 21.08B by 2030 for warehouse robotics overall. mordorintelligence MarketGrowthReports (AGV/AMR): USD 12.03B by 2033. marketgrowthreports LogisticsIQ: AGV+AMR to ~USD 22B by 2030. |

Mordor: 17.70% (2025–2030) for warehouse robotics market. mordorintelligence AGV/AMR subset: ~18% overall, with AMR >30% to 2030. |

Mordor Intelligence “Warehouse Robots Market”. mordorintelligence LogisticsIQ Mobile Robots (AGV & AMR) 5th‑edition research. prnewswire+1 MarketGrowthReports AGV/AMR market report. |

Note: these Forcast and relative data are indexed from above mordorintelligence/ marketsandmarkets/market.us/marketgrowthreports website (you can open their original links by click blue word then check more)

The pattern is consistent:

This is the backdrop for 2026:

Edge AI is becoming a practical procurement decision for digital signage, AI retail, robotics, and industrial customers – and cameras are one of the simplest ways to unlock value from that investment.

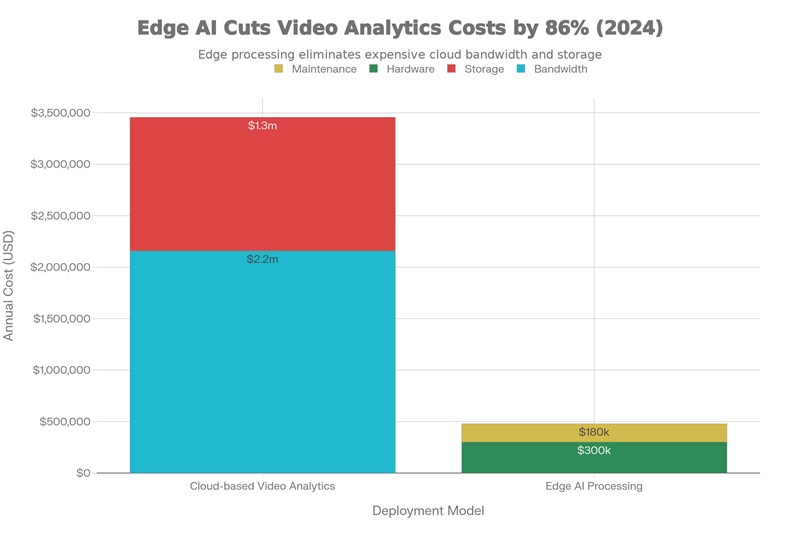

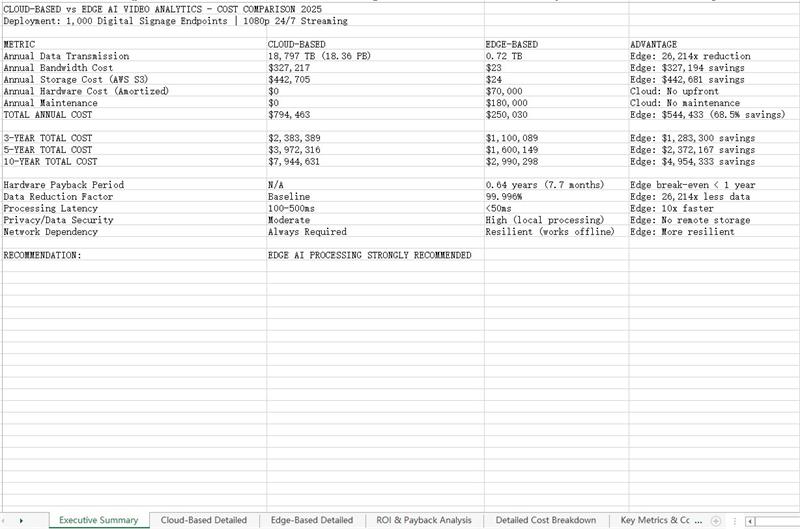

2, Why Edge AI Is Becoming the Default Architecture

Cloud Vision Is Technically Possible — But Financially Unsustainable

By late 2025, most AI vision systems had already proven technical feasibility.

The real bottleneck emerged elsewhere: operational cost at scale.

Continuous video streaming to the cloud introduces:

•Persistent bandwidth consumption

•Storage and retention liabilities

•Ongoing inference costs tied directly to usage growth

Our cost model is not a guess. Based on current AWS Kinesis Video Streams pricing and S3 storage rates [Source: AWS Pricing 2025], a standard 1080p stream consumes over 18TB of data annually per device (Source Data: Derived from AWS & Azure 2025 public bandwidth pricing models for continuous 1080p streaming)

At multi-site scale, cloud-based video analytics transforms from a flexible prototype into a compounding operational expense. This has pushed enterprises toward edge AI computing, where video is processed locally and only metadata is retained.

Key industry keywords naturally associated with this shift include:

•edge AI computing

•industrial AI box

•embedded vision system

•real-time video analytics

2026 Insight:

Edge AI is no longer chosen because it is faster — it is chosen because it allows predictable long-term OPEX.

3. Digital Signage Is Evolving From Playback to Proof

The End of “Blind Screens” in DOOH

Traditional digital signage media players were designed for content playback, not intelligence. As CPM rates compress and inventory increases, advertisers increasingly demand proof of attention, not just screen uptime.

This has accelerated adoption of:

•audience measurement

•dwell-time analytics

•anonymous presence detection

Importantly, advertisers do not require identity recognition. They require confirmation that content was actually seen.

This has shifted the industry toward edge-based computer vision, where visual signals are processed locally without storing images.

High-value search keywords aligned with this transition include:

•digital signage media player

•DOOH audience analytics

•edge AI signage

•AI powered media player

2026 Insight:

Screens that cannot validate attention will increasingly lose premium advertising budgets.

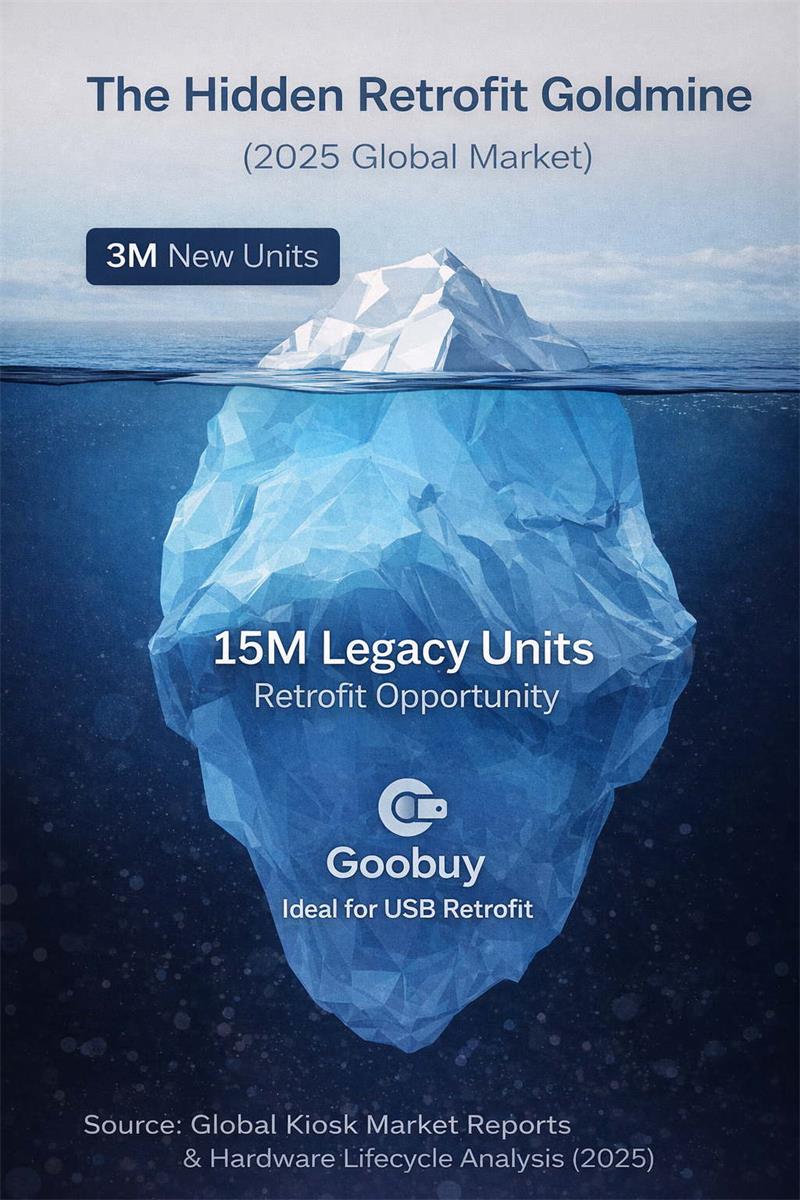

4. The Real Market Opportunity Is Retrofit, Not Replacement

Why Legacy Hardware Is the Largest Untapped AI Vision Market

While industry discussion often focuses on new deployments, the reality is different:

•The installed base of legacy media players, kiosks, and industrial terminals far exceeds annual new shipments.

•Full system replacement involves long approval cycles, high CAPEX, and integration risk.

•Retrofit upgrades offer faster ROI and simpler decision paths.

Across signage networks, retail environments, and industrial facilities, decision-makers increasingly favor incremental intelligence upgrades rather than wholesale replacements.

This reality explains rising interest in:

•USB camera retrofit

•edge AI upgrade

•legacy system modernization

•AI enablement for existing hardware

2026 Insight:

The largest edge AI growth wave will come from making existing hardware intelligent, not replacing it.

Industry analysis suggests the average lifespan of a self-service kiosk is 5-7 years. This means millions of units deployed before 2022 are functionally sound but 'visually blind'—creating a massive retrofit opportunity.

Source Data: Global Kiosk Market Reports & Hardware Lifecycle Analysis (2025)

5. Privacy Compliance Has Become a Deployment Accelerator

From Legal Obstacle to Strategic Advantage

AI vision adoption in Europe and North America has been shaped by GDPR, biometric regulations, and data-protection rulings. The lesson from 2025 is clear:

•Systems that store identifiable images trigger extended legal review.

•Projects that avoid image retention deploy faster and scale sooner.

Edge AI architectures that perform on-device analytics without storing personal data now enjoy:

•Faster internal approvals

•Reduced regulatory exposure

•Lower long-term compliance cost

Key compliance-related search terms increasingly associated with procurement decisions include:

•GDPR compliant AI

•privacy-safe computer vision

•edge analytics without cloud

•non-biometric vision systems

2026 Insight:

Privacy-by-design is no longer a constraint — it is a competitive advantage.

The risk is real. Just ask the Spanish retailer Mercadona, who faced a €2.5 million fine for unlawful facial recognition. Legal experts explicitly recommend 'Edge Processing' to mitigate these GDPR and BIPA risks.

The Privacy Shield: Cloud Risk vs. Edge Safety (GDPR/BIPA)

Source Case: AEPD (Spanish Data Protection Agency) Fine against Mercadona, 2021/2024 precedent

[Conclusion & Next Steps]

The Verdict: It's Time to Re-Calculate. The hardware decisions made in 2024 may be the liabilities of 2026. Whether it is cloud costs, fraud losses, or maintenance downtime, the "Hidden Costs" of computer vision are rising.

Audit Your Projects: To help engineers and business leaders assess their exposure, we have released an open-source 2026 ROI Calculator. This Excel tool allows you to input your specific deployment numbers (bandwidth, electricity, shrink rate) to see the financial impact of your current architecture.

[Download the 2026 Edge AI ROI Calculator (.xlsx)]

6. Four Industries, One Shared Engineering Reality

Despite different use cases, the same operational pain points appear across sectors:

|

Industry |

Visible Goal |

Underlying Challenge |

|

Digital Signage |

Monetize attention |

Cost control & CMS integration |

|

AI Retail & Kiosk |

Reduce shrinkage |

False positives & legal risk |

|

Industrial AI Box |

Visual inspection |

Latency & OT integration |

|

Robotics |

Autonomous perception |

Sensor reliability & synchronization |

Across all four, failures rarely stem from AI models.

They stem from system integration, reliability, and long-term operability.

2026 Insight:

AI vision is now a systems engineering discipline, not a software experiment.

AI Retail & Kiosk

Pain 1: The "Banana Trick" & The 4x Shrink Crisis

Sector: Retail Automation & Self-Checkout

The Data: Retailers are pulling back on Self-Checkout (SCO) deployments. Why? Because shrinkage at unmonitored SCO lanes has hit 3.75% of inventory—nearly 4x higher than staffed lanes.

The Trend: The primary culprit isn't high-tech hacking; it's the analog "Banana Trick" (Item Switching), where expensive items (like steak) are weighed as cheap produce. The 2026 Reality: Legacy weight scales are failing to stop this. The industry data suggests that without visual validation (Computer Vision), the ROI of self-checkout automation turns negative due to fraud losses.

• Shocking data: Theft and errors at self-checkout systems account for 34% of total retail losses in the United States.

• Loss amount: Retailers lose about $4.9 billion annually due to self-checkout theft.

• Reversing the trend: Due to high losses, giants like Dollar General and Target began phasing out older self-checkout machines in 2025, unless new loss-prevention technologies are introduced.

Table 1 – Self‑checkout shrink & fraud (banana trick, mis‑scans)

| Metric | Value | Context | Source | Year |

|---|---|---|---|---|

| Non‑scanning at fixed SCO as % of SCO sales | 0.44% | Loss from non‑scanned items at fixed self‑checkout as a share of SCO sales | ECR Retail Loss – “Self‑Checkout in Retail: Measuring the Impact on Loss”ecrloss | 2022 (used in 2025 discussions) |

| Share of total store‑recorded shrink from SCO non‑scanning | 9.5% | Portion of total shrink attributed to non‑scanning at fixed self‑checkout | ECR Retail Loss ecrloss | 2022 |

| Overall losses at Scan & Go scenario | 0.96% of sales | Modeled loss at studied utilization levels for Scan & Go | ECR Retail Loss ecrloss | 2022 |

| Increase in overall losses vs baseline | 43% | Relative increase in losses at Scan & Go vs non‑SCO baseline | ECR Retail Loss ecrloss | 2022 |

| Overall shrink at self‑checkout lanes | 3.75% of inventory | Approximate shrink rate for inventory at SCO vs staffed checkouts | Capital One Shopping – Self‑Checkout Statistics capitaloneshopping | 2025 |

| Increase in shrink at self‑checkout vs traditional checkouts | 65% | Shrink at SCO described as up to 65% higher than at traditional checkouts | Capital One Shopping capitaloneshopping | 2025 |

| Share of total retail shrink attributed to self‑checkout theft | 34% | Portion of overall retail shrink linked to SCO theft in the US | WifiTalents – Self Checkout Theft Statistics wifitalents | 2025 |

| Maximum shrink‑reduction from AI‑based theft detection | up to 35% | Estimated reduction in SCO theft incidents with AI‑based detection | WifiTalents wifitalents | 2025 |

continue on reading part 2 here 2026 Edge AI Vision Trends: Signage player, AI Retail, Robotics & Industrial AI Boxes(2)